Latest SEC Filings Reveal Major Trucking Companies Still Outsourcing Vast Amounts of Freight

LaneAxis research spanning seven years shows problematic “Purchased Transportation” remains prevalent

NEWPORT BEACH, CA, USA, March 16, 2023/EINPresswire.com/ -- Even seven years later, the practice of large trucking companies surreptitiously outsourcing freight to smaller carriers continues to stifle transparency and drive up costs, particularly for the shipping companies hiring these large transportation firms to haul their loads. Small trucking companies are also paying a price.

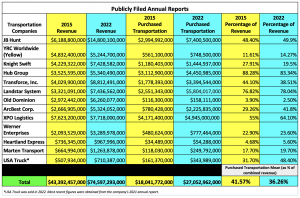

In 2016, LaneAxis took a deep dive examining the practice of “Purchased Transportation” - essentially a euphemism for large carriers subcontracting freight to the 97% of the industry that’s comprised of smaller, independent carriers owning just a handful of trucks. In reviewing the 2015 annual reports of the 13 largest publicly held transportation firms at the time, LaneAxis found those companies spent a combined $18+ billion on purchased transportation. On average, that amounted to more than 41% of those carrier’s total revenue being spent on subcontracting freight.

Fast forward to today, and little has changed.

LaneAxis reviewed the recently filed 2022 SEC reports of those same companies to make an “apples to apples” line-item comparison with the 2015 reports. In short, all 13 companies posted increased revenue – in some cases more than double what they reported in 2015 – and all 13 companies increased their overall purchased transportation spend. This despite the fact that technology has advanced exponentially over the past seven years, dramatically simplifying the ability for shippers to contract directly with the small carriers who have largely been hauling their freight all along.

The attached table (which you can also view here) compares the 2015 and 2022 totals that each company earned in revenue, the amount each spent on purchased transportation, and the overall percentage of revenue each spent on purchased transportation. The bottom line aggregates the totals and provides the mean average (as a percentage) that all the companies spent on purchased transportation against the cumulative overall annual revenue total.

As you can see, from 2015 to 2022 all companies showed increased revenue and increased total spend on purchased transportation. Although the cumulative average percentage of revenue spent on purchased transportation technically dropped from 41.57% to 36.26%, that dip can largely be attributed to the massive overall increase in revenue over the past seven years – more than $30 billion in total. But the fact remains that on average these companies are spending more than one-third of their revenue on subcontracting, a figure that still hovers around the 40% mark.

“Reviewing this seven years later, these numbers jump off the page,” says LaneAxis CEO & Founder Rick Burnett. “Most notably, it suggests large shippers’ C-level decision-makers are simply not looking at real, hard data. Buying capacity on an annual basis will soon become a thing of the past. Currently, many shipping companies are entering into annual contracts with major carriers apparently unaware (or ignoring) that those carriers don’t have the internal capacity to handle all their daily loads, and are in fact ‘brokering’ many of their shipments to smaller trucking companies – the 97%. The latest data highlights the fact that these independent carriers are already hauling 30-40% of these shippers’ loads, and obviously doing so at high performance levels. By contracting directly with the 97%, shippers can expect cost-savings of 20-30%, effectively negating the $27 billion currently going down the drain in the form of purchased transportation. As we’ve seen over the past 25 years, corporate executives that can grasp a vision and become early adopters will be the real winners.”

------------------------

WATCH: LaneAxis CEO on the Many Pitfalls of Purchased Transportation

------------------------

When LaneAxis released its findings in 2016, we received pushback from some large carriers claiming that “Purchased Transportation” does not solely reflect subcontracted freight. While that is true, freight outsourcing by far represents the largest portion of their purchased transportation spend. Law Insider defines the term as follows:

“Purchased Transportation means any account arising from the transportation of goods where all or a portion of the transportation services are rendered by an owner operator or independent third party transportation provider.”

Even Knight-Swift’s own 2022 report defined “purchased transportation” in similar fashion:

“Purchased Transportation expense is comprised of payments to independent contractors in our trucking operations, as well as payments to third-party capacity providers…”

In other words, “Purchased Transportation” is virtually synonymous with “brokered freight.” In both cases, an intermediary is charging a premium to shippers to move loads, then offloading those loads to small carriers at a fraction of what they were initially paid. In both cases, the intermediary pockets the difference, and small trucking companies often end up earning a relative pittance that barely covers their operational costs.

Burnett says in transportation today there’s no incentive by ‘managed freight services’ to drive efficiencies because that’s where they make their margins – off the backs of independent carriers. They don’t drive cost-savings to shippers, they drive increased revenue for themselves.

"The biggest issue in transportation today is daily capacity constraints,” adds Burnett. “This is because there is simply no real-time visibility into the small, independent carrier network. That’s where LaneAxis technology comes in. Shippers can now build direct contractual relationships with their private network of independent carriers. All carriers are approved by the shipper, insurance documents are verified through the network, and all loads are tracked in real-time. Performance metrics are also quantified on each load, with key KPIs such as loading and unloading times and on-time arrivals all stored on LaneAxis’ private blockchain. This is the future of transportation: an efficient network where shippers and carriers can deal direct with full confidence in each other.”

About LaneAxis

LaneAxis, Inc., is a proprietary Web3 Direct Freight Network that connects shippers directly to carriers, eliminating the need for costly and often unscrupulous intermediaries such as freight brokers. Our end-to-end supply chain solution leverages patented software, blockchain, smart contracts, artificial intelligence, and automation to help cure the critically damaged freight transportation industry. The LaneAxis Direct Network is focused on eliminating $200 billion in annual "managed broker fees," 29 billion empty truck miles per year, and streamlining an industry that lacks transparency, trust, and efficiency.

Andrew Rivera

LaneAxis, Inc.

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

TikTok

The Pitfalls of Purchased Transportation: A Challenge To C-Suite Shippers

Distribution channels: Business & Economy, Manufacturing, Retail, Shipping, Storage & Logistics, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release