Railway Propulsion System Market : Increasing Size, Growth Rate, and Forecast 2032 | Hitachi Ltd, Alstom, Toshiba Corp

Railway Propulsion System Market

Railway Propulsion System Market by Type, by Application, by End User : Global Opportunity Analysis and Industry Forecast, 2023-2032

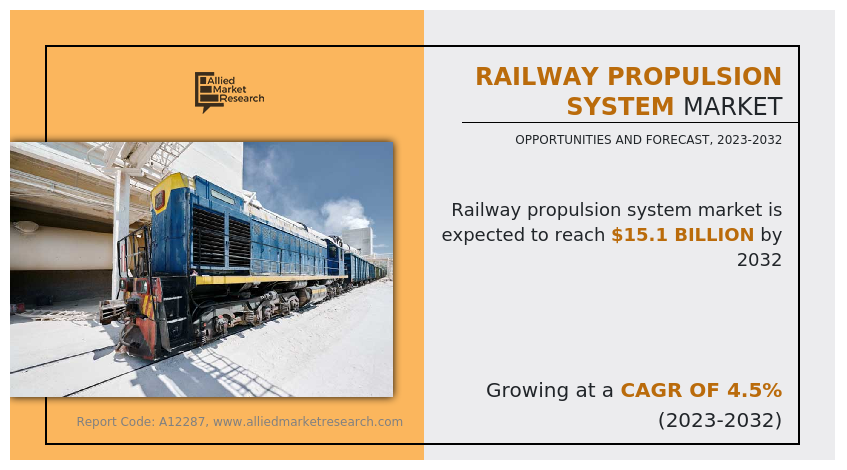

PORTLAND, OR, UNITED STATES, August 10, 2023/EINPresswire.com/ -- The global railway propulsion system market size was estimated at $9.9 billion in 2022, and is estimated to reach $15.1 billion by 2032, registering a CAGR of 4.5% from 2023 to 2032.

The growth of the global railway propulsion system market is driven an rise in distribution of budget for varies development of railways projects, upsurge in use of public transport services as a solution to minimize traffic congestion, growth in demand for safety and compliance in rail transit, and increase in demand for passenger and freight capacity drive the growth of the are the key factor that supports the growth of the railway propulsion system market share during the forecast period.

The railway propulsion system market is segmented on the basis of type, application, end user, and region. By type, it is categorized into diesel, diesel-electric, and electric locomotive. By application, it is fragmented into locomotive, metro, monorail, trams, and others. By end user, it is bifurcated into passenger transit, and cargo transit. By region, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 – https://www.alliedmarketresearch.com/request-sample/12652

Developing countries especially in Asia such as India, Japan and others are focused on the enhancement of their railway infrastructure by distributing higher budgets for developments in railway projects. For instance, the Indian government planned to install railway systems such as Automatic Train Protection (ATP) System in the 300 to 400 Vande Bharat trains that are expected to be announced in the Budget 2023-24 to upgrade its rolling stock. Similarly, the government of India allocated a budget of around $15.06 billion for the railways, with a total capital outlay of $30.80 billion for the financial year 2021-2022, which highlights an increase of 33% in total capital expenditure for 2021-22 over $22.4 billion for 2020-21.

Likewise, heavy investment to implement modern technologies in propulsion systems and improve railway infrastructure is expected to drive the growth of the market. For instance, in June 2022, the European Union (EU) announced an investment of $5.7 billion to support 135 transport infrastructure projects across the continent. Therefore, an upsurge in budget allocation acts as a key factor that drives the growth of the global railway propulsion system market industry.

Furthermore, the population rate has increased the sales of private vehicles such as bikes, passenger cars, and more across the globe which contributes to traffic congestion on roads. People are increasingly choosing public transport as it reduces on-road congestion and provides a timesaving, comfortable, and economical mode of transportation. Thus, factors such as an increase in vehicle emissions, growth in concerns related to safety, and greater demand for faster commutes have increased the preference of individuals for rail transport.

𝐌𝐚𝐤𝐞 𝐚𝐧 𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 - https://www.alliedmarketresearch.com/purchase-enquiry/12652

Moreover, several railway groups across the globe are working toward several developments in rail networks and investing in advancing high-speed trains to meet the growing demand for public transport. For instance, in September 2022, British Columbia invested in a high-speed rail study to link major Pacific Northwest cities. The province is expected to provide $300,000 to study the next phase of the Ultra-High-Speed Ground Transportation Project designed to link Vancouver, Seattle, and Portland. Similarly, in July 2021, the U.S. Department of Transportation (USDOT) and the State of California together invest around $928.9 million in federal grant funding to support California’s High-Speed Rail project.

On the basis of type, the railway propulsion system market is segregated into diesel, diesel-electric, and electric locomotive. A diesel-electric propulsion system refers to a power system that combines a diesel engine with an electric generator and electric traction motors. The diesel engine is the primary source of mechanical power.

There is a rise in the development and integration of diesel-electric propulsion technology in different types of railways. For instance, in December 2022, Tesmec received a contract for the delivery of bi-mode infrastructure maintenance vehicles. The vehicles are equipped with a diesel-electric propulsion system and ETCS Level 2 onboard equipment. The new vehicles are expected to be certified to enable them to operate as passenger trains throughout the RFI network. Moreover, there is a surge in the demand for reliable and efficient transportation solutions in the railway industry. For instance, in September 2020, India delivered two Diesel-Electric Multiple Unit (DMUC) trains equipped with a diesel-electric propulsion system to the Nepal Railway for Jaynagar-Kurtha broad gauge line. Such developments drive the growth of the segment in the market.

Key players covered in the railway propulsion system market report include CRRC Corporation Limited, Hitachi, Ltd., Mitsubishi Corporation, Siemens, Toshiba Corporation, Alstom, Medcom, Titagarh Rail Systems Limited, ABB, and Fuji Electric Co., Ltd.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐚𝐭 - https://www.alliedmarketresearch.com/request-for-customization/12652

COVID-19 Impact Analysis

The outbreak of COVID-19 resulted in travel restrictions, lockdown measures, and reduced passenger and freight movements. Numerous railway infrastructure projects related to propulsion system upgrades or new installations witnessed delays due to the pandemic. However, as the lockdown was lifted throughout the world, it led to an easing of the trade and travel restrictions. The demand for railway systems experienced recovery as the operations of manufacturing companies and factories were resumed, initiating the continuation of railway projects around the world. The leading market players are taking various measures to deal with the negative effects of the outbreak of COVID-19. For instance, CRRC (China) is using the current market scenario to further strengthen its position by making strategic future-oriented investments and following a strict cost management program.

𝐒𝐢𝐦𝐢𝐥𝐚𝐫 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐖𝐞 𝐇𝐚𝐯𝐞 𝐨𝐧 𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 :

Automotive Trailer Market : https://www.alliedmarketresearch.com/automotive-trailer-market

E-Drive for Automotive Market : https://www.alliedmarketresearch.com/e-drive-for-automotive-market-A10339

Automotive Gesture Recognition System Market : https://www.alliedmarketresearch.com/automotive-recognition-system-market

David Correa

Allied Analytics LLP

1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Distribution channels: Automotive Industry, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release