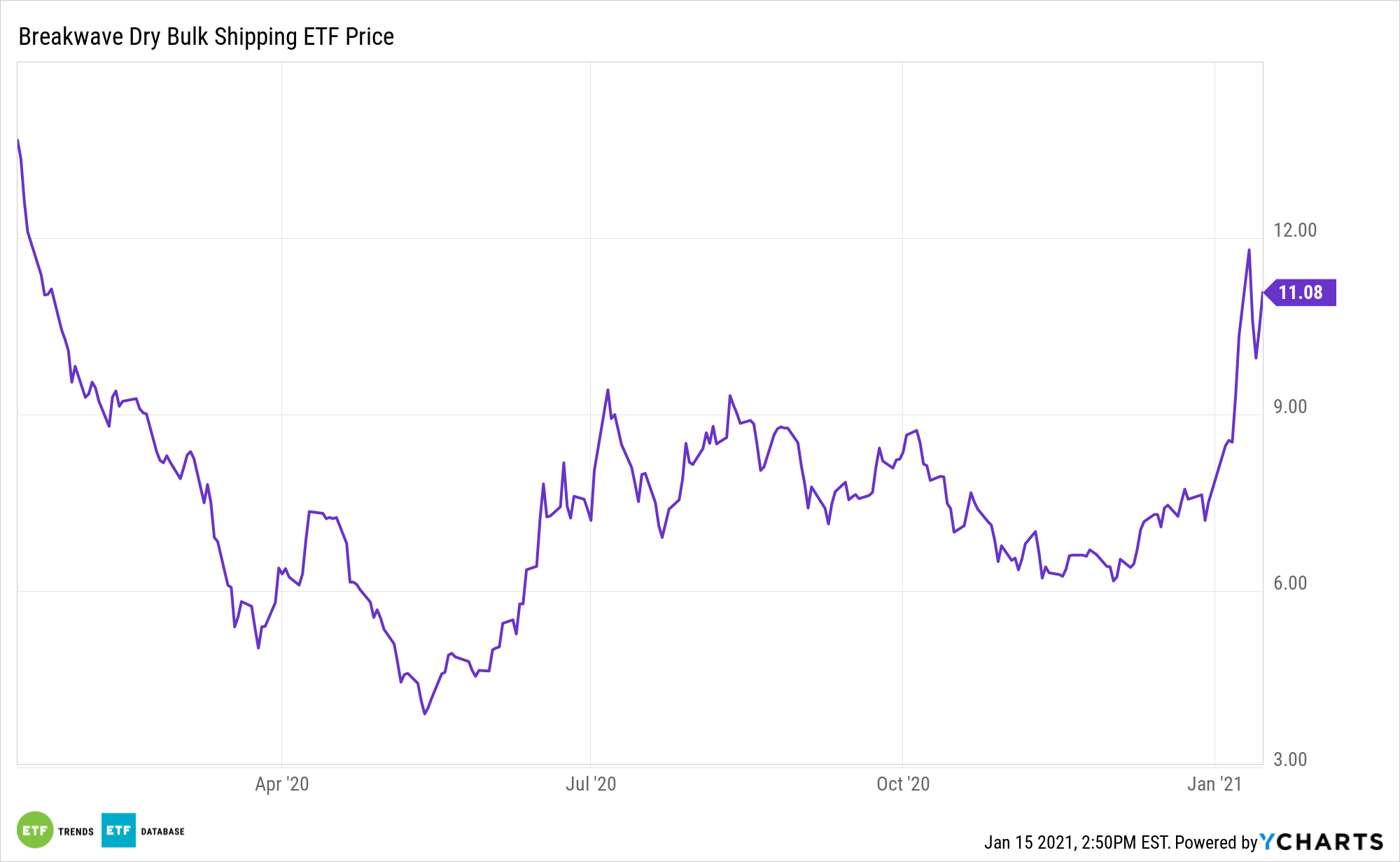

A targeted dry bulk shipping exchange traded fund has rallied in the new year, breaking from traditionally weak seasonal trends.

Among the best performing non-leveraged ETFs of Friday, the Breakwave Dry Bulk Shipping ETF (NYSEArca: BDRY) jumped 6.9%. BDRY has already surged 36.0% so far in 2021.

BDRY tries to provide exposure to the daily changes in the price of dry bulk freight futures by tracking a three-month strip of the nearest calendar quarter of futures contracts on specified indexes that measure rates for shipping dry bulk freight.

Capesize freight rates have touched a three-month high in January as supply chain bottlenecks from poor weather conditions across the Chinese coast and high commodity prices helped drive up demand for tonnage shipping, S&P Global reports.

“The weather will be the key for the tonnage supply, which would determine the trajectory of freight rates,” a ship-owner source told S&P Global.

The arctic ice blast blowing across China has affected normal cargo operations, especially around north China, which has tightened tonnage supply in the past two weeks.

Consequently, there is a wide imbalance in trade out of the Pacific markets. Owners have embraced shorter trips within the Pacific region compared to a longer trip through Brazil, which has resulted in fewer ships ballasting to the Atlantic, and caused charterers with cargoes in that region to raise prices to secure tonnage shipped.

Furthermore, rebound in the economic recovery, notably in China, has helped increase demand for raw materials. China has exhibited rising demand for iron ore amid supply concerns persisting in Brazil.

“Increased demand for coal from Indonesia going into China has definitely boosted the rates in the Pacific,” Rebecca Galanopoulos Jones, head of research at Alibra Shipping, told Reuters.

For more information on the market sectors, visit our sector ETFs category.